What the Wealthy Know About Offshore Trusts That You Don’t

What the Wealthy Know About Offshore Trusts That You Don’t

Blog Article

Exploring the Secret Attributes and Benefits of Utilizing an Offshore Depend On for Riches Monitoring

When it comes to wide range management, you may find that an overseas count on provides one-of-a-kind benefits you hadn't considered. These counts on can enhance possession protection, offer tax obligation efficiencies, and keep your privacy. By recognizing their essential functions, you can make educated choices about your financial future. Exactly how do you pick the ideal jurisdiction, and what details benefits could use to your scenario? Allow's check out these necessary aspects even more.

Comprehending Offshore Trusts: Interpretation and Function

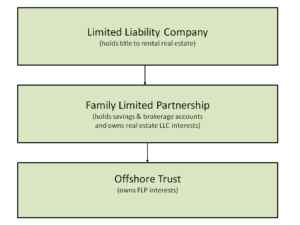

Offshore trust funds work as powerful tools for wide range administration, supplying people with critical choices for asset defense and tax obligation effectiveness. These counts on are lawful entities established in jurisdictions outside your home nation, permitting you to protect your possessions from financial institutions, claims, and even possible tax. By positioning your riches in an offshore depend on, you acquire a layer of defense that could not be readily available locally.

The primary purpose of an offshore trust is to aid you preserve control over your assets while ensuring they're managed according to your wishes. You can mark beneficiaries, specify just how and when they obtain distributions, and also set conditions for possession accessibility. Additionally, offshore trusts can improve personal privacy since they frequently protect your economic information from public examination. Comprehending these essentials can encourage you to make informed choices concerning your wealth management approach and discover the benefits of overseas trusts efficiently.

Trick Attributes of Offshore Depends On

When taking into consideration offshore trust funds, you'll discover 2 standout functions: property security methods and tax effectiveness benefits. These trusts can secure your wealth from lawful cases while additionally enhancing your tax situation. Allow's check out exactly how these essential features can work to your benefit.

Possession Protection Strategies

One of the most engaging functions of offshore depends on is their capability to guard possessions from potential legal cases and creditors. When you develop an offshore depend on, your properties are held in a jurisdiction with solid privacy legislations and favorable policies. In addition, offshore depends on typically give a layer of security versus political or economic instability in your home nation.

Tax Performance Benefits

Developing an overseas trust not only offers strong asset defense but also presents significant tax performance benefits. By putting your possessions in an overseas trust fund, you can take advantage of beneficial tax programs that numerous territories supply. These trust funds can aid you postpone tax obligations, possibly reducing your general tax obligation problem. Furthermore, earnings produced within the count on may not be subject to local taxes, giving you the possibility to expand your wealth better. You'll likewise have more control over circulations, enabling you to manage when and how your beneficiaries receive funds, which can lead to more tax obligation advantages. Ultimately, an overseas depend on can be a powerful device for enhancing your riches monitoring technique.

Possession Defense Benefits

Since you're seeking to protect your wide range, comprehending the asset defense benefits of an overseas count on is crucial. An offshore trust fund can shield your properties from creditors, legal actions, and unexpected monetary challenges. Offshore Trusts. By putting your wide range in this structure, you produce a legal barrier that makes it hard for others to declare your properties

Additionally, offshore trust funds usually operate under jurisdictions with durable personal privacy laws, indicating your economic details remains private. This personal privacy can deter possible litigants or plaintiffs from pursuing your possessions.

Tax Obligation Benefits of Offshore Depends On

While several capitalists look for methods to reduce their tax liabilities, offshore trusts can provide a strategic method for attaining tax obligation advantages. By putting your assets in an overseas depend on, you may take advantage of reduced discover here taxes depending upon the jurisdiction's guidelines. Several offshore jurisdictions provide favorable tax obligation rates or perhaps tax exceptions, enabling your wide range to expand without the problem of extreme tax obligations.

Furthermore, offshore counts on can aid defer tax obligations on funding gains until distributions are made, offering you more control over when you understand those gains. You may likewise have the ability to shield specific properties from taxes, depending on the trust fund structure and regional regulations. This versatility can enhance your overall riches administration technique.

Moreover, using an overseas depend on can help you navigate complicated global tax obligation policies, guaranteeing that you're certified while optimizing your tax placement. In other words, offshore depends on can be a powerful tool in your wealth monitoring toolbox.

Personal Privacy and Discretion Enhancements

When you established up an offshore depend on, you obtain enhanced monetary personal privacy that safeguards your possessions from unwanted scrutiny. Lawful confidentiality defenses better secure your details from possible leakages and violations. These attributes not just safeguard your wide range however likewise give comfort as you navigate your monetary method.

Enhanced Financial Privacy

Enhanced monetary privacy is one of the vital benefits of establishing an overseas depend on, as it enables you to protect your assets from spying eyes. By putting your wealth in an overseas trust fund, you can substantially decrease the risk of undesirable examination from authorities or the general public. This framework keeps your economic affairs very discreet, making sure that your investments and holdings continue to be private. Additionally, overseas territories often have rigorous privacy regulations that better safeguard your information from disclosure. You get control over who has accessibility to your financial information, which assists shield you from possible risks like lawsuits or economic disputes. Inevitably, improved personal privacy not just secures your properties however additionally grants you satisfaction regarding your economic future.

Legal Confidentiality Securities

Offshore trusts not just supply improved financial personal privacy however also supply durable legal discretion securities that shield your properties from external analysis. With offshore trusts, you can guard your riches against legal difficulties, lender insurance claims, and various other risks while appreciating the privacy you are worthy of in your wide range management approach.

Estate Planning and Wide Range Preservation

Estate preparation and wealth conservation are necessary for securing your economic future and ensuring your properties are secured for generations to come. By developing an offshore count on, you can efficiently manage your estate, guarding your riches site web from potential creditors and legal challenges. This positive technique permits you to determine how your possessions are dispersed, guaranteeing your wishes are recognized.

Making use of an offshore count on additionally provides you with various tax obligation benefits, which can help optimize your wealth. You can lower inheritance tax, allowing even more of your riches to be passed on to your successors. Furthermore, an overseas count on can protect your possessions from political or economic instability, further protecting your monetary legacy.

Integrating an offshore trust into your estate link planning technique not just boosts wide range preservation but likewise brings satisfaction, understanding that your hard-earned possessions will certainly be protected for future generations.

Selecting the Right Jurisdiction for Your Offshore Trust

Just how do you pick the best territory for your offshore depend on? Look for territories with strong possession security laws and regulative security. This assures your trust remains secure against potential obstacles.

You ought to additionally assess the online reputation of the territory. A well-regarded location can enhance trustworthiness and decrease scrutiny. Think of availability also; you intend to conveniently connect with local trustees and advisors. Think about any kind of language obstacles and cultural distinctions that may impact your experience.

Often Asked Concerns

Can I Set up an Offshore Count On Without a Financial Expert?

Yes, you can establish up an offshore count on without a financial consultant, yet it's risky. You'll require to study lawful requirements and tax obligation effects extensively to guarantee conformity and protect your possessions efficiently.

Are Offshore Trusts Legal in All Nations?

Offshore trusts are lawful in numerous countries, but not all. You'll need to check the specific laws in your nation and the territory where you prepare to develop the count on to guarantee compliance.

Just how much Does It Price to Establish an Offshore Depend On?

Establishing an offshore trust fund typically costs between $2,000 and $10,000, depending upon factors like jurisdiction and intricacy. You'll also encounter ongoing charges for administration and conformity, so prepare for those costs, as well.

Can Recipients Accessibility Funds in an Offshore Trust Fund?

Yes, beneficiaries can access funds in an overseas trust, however it commonly relies on the details conditions established by the count on. You need to assess those information to recognize the gain access to regulations plainly.

What Occurs if I Return to My Home Nation?

If you return to your home country, you'll require to contemplate neighborhood tax obligation effects and policies relating to overseas trusts. It's crucial to consult a legal specialist to browse these changes effectively.

Report this page